The beginners’ guide to investing: brought to you by Stake

Money talks right? With chatter around investing and money matters reaching fever pitch, Remix caught up with the team behind digital brokerage platform, Stake, to get the inside scoop on all things stocks, ETFs and investing made easy. Here, the Stake team spills the beans on accessible investing, how to get started and the benefits of digital investment platforms.

Why should you start investing?

By investing consistently and committing over time opens investors up to generate interest, thanks to Einstein’s 8th wonder: compounding returns. The market* grows by 8% a year on average. Over time that 8% compounds to significant figures. For example, investing $1000 in the S&P500 with $200 added monthly would be worth $300,000 in 30 years. This is how investing your money can make your money work harder than it would sitting in a savings account.

Of course, returns aren't guaranteed. Markets are volatile and risky and past performance doesn't indicate future performance but so far, the stock market has been one of the greatest wealth-generating engines around.

*the market as measured by the S&P500; a basket of the 500 biggest companies in America. Below we will go into how you can own the market through ETFs.

How do you invest?

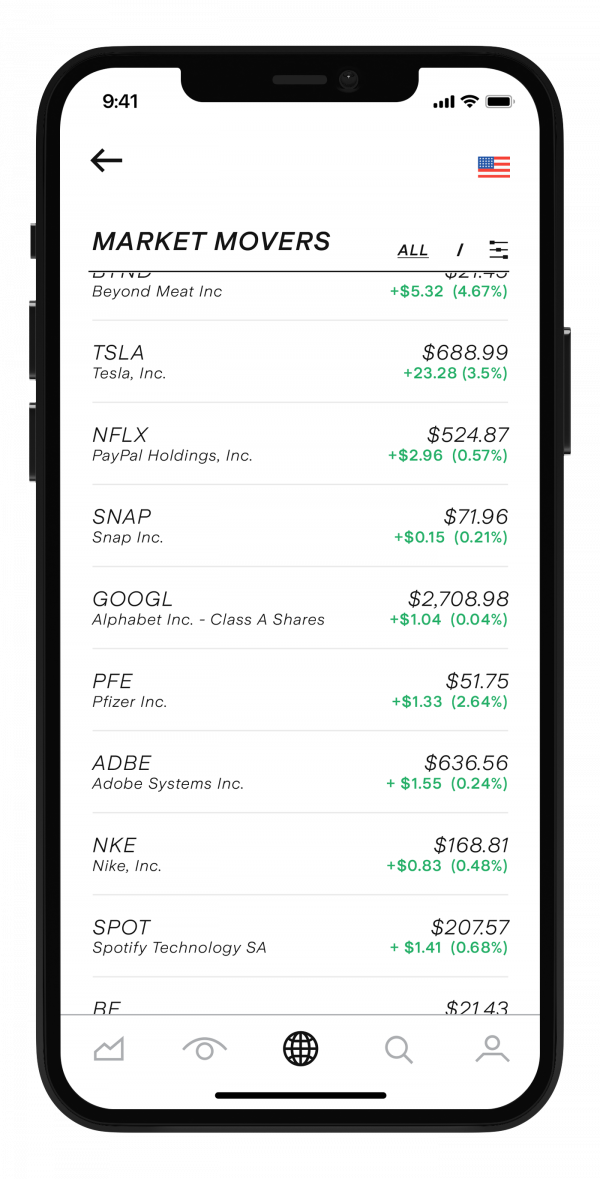

Apps like Stake have changed the space of investing, you no longer require thousands of dollars and a broker to get started. Digital Brokers have made the stock market accessible to everyone with low fees, a quick sign up process, and a very accessible trading experience. You don’t need much to get started!

What are the different types of investments beginners can get into?

To make it simple, we’d like to break down the difference between Individual Stocks versus EFTs and then outline their pros and cons. EFTs (or Exchange Traded Funds) are baskets of stocks, meaning a range of companies are put together and split up into individual shares. Individual Stocks are single stocks from companies selected by you specifically.

Pros of EFTS

✓Exposure to a professionally managed portfolio.

✓ Exposure to the best performers in a sector.

✓ Index ETFs often outperform hedge fund returns over the long run.

Cons of EFTS

✖ Management fees: ETF managers charge a fee that eats into returns.

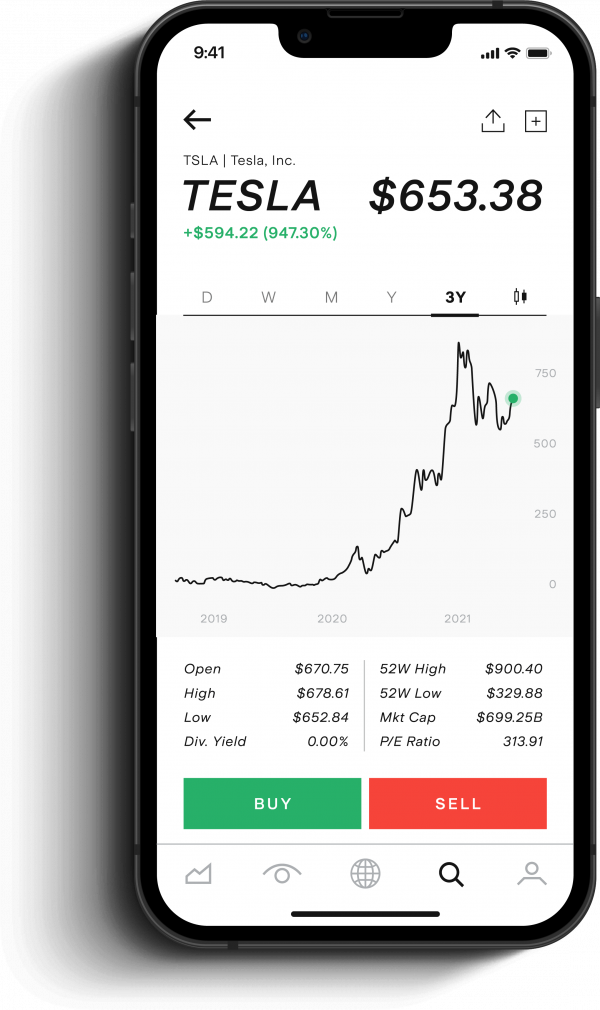

✖ High conviction investors may miss out on the mega gains from investing in specific names. For example, Tesla is up 30x in the last five years but wasn’t added to the S&P500 until last year. It would take decades of ETF growth to make up for the super-performers of the stock market.

Pros of STOCKS

✓ Ability to have concentrated exposure to specific super-performing stocks.

✓ No management fees.

✓ Voting rights attached to share ownership.

Cons of STOCKS

✖ Deeper research and analysis needed to select.

✖ Portfolio made up of a few individual stocks is more prone to volatility.

✖ Can be difficult to outperform the market in the long run with a portfolio of selected names.

Pro tip: Typically, a mix of both ETFs and individual shares is seen in a balanced portfolio!

What is Stake & how does the platform work for first-time investors?

Stake is a digital brokerage platform that makes investing easy. Stake gives Kiwis access to over 6,000+ US stocks and ETFs with no brokerage and no monthly account fees. With zero paperwork, first-time investors can open an account and begin investing in minutes, starting out with as little as $50NZD. We've simplified the process, and brought Wall Street to the palm of your hand.

What is Stake doing to make investing more accessible to the everyday person?

Stake provides access to low-cost trading in the world's most active stock market. Our mission is to build a confident and thriving community of Kiwi investors, equipping our members with everything they need to feel empowered to trade, including market insights and commentary, weekly market wrap emails, and our educational content series, Stake Academy.

What are some key things investors should look for in a stock?

Every investor is different, and there are countless methods to evaluate stocks, but typical common threads that underpin most evaluation techniques include:

Growth

Every company will have a different key metric that they try to grow. For Facebook it's users, for Airbnb, it's nights booked, for other companies it may be revenue. Try to find each company's "north star metric" and ensure they are growing,

Knowledge of the sector/company

We naturally understand the business models of so many companies that we use daily. To an extent, you may already be an expert on a company like Lululemon or Netflix just by loyally following the brand, focusing on industries and businesses you understand is a great starting point.

Strong leadership

Generally, investing in founders with a track record of success and industry knowledge can pay off. Do your research, and invest in companies with strong leaders.

What are some of the benefits of investing early, and regularly?

Getting started can seem daunting, but starting slow and low and building understanding, knowledge and confidence is better than doing nothing. The greatest benefit of investing early is having the power of the financial markets on your side for a longer period of time, even if that looks like $50 going into your portfolio every month. Investing early and in regular intervals lends itself to taking advantage of compounding interest.

Find out more about investing at HELLOSTAKE.COM or download Stake from the app store.